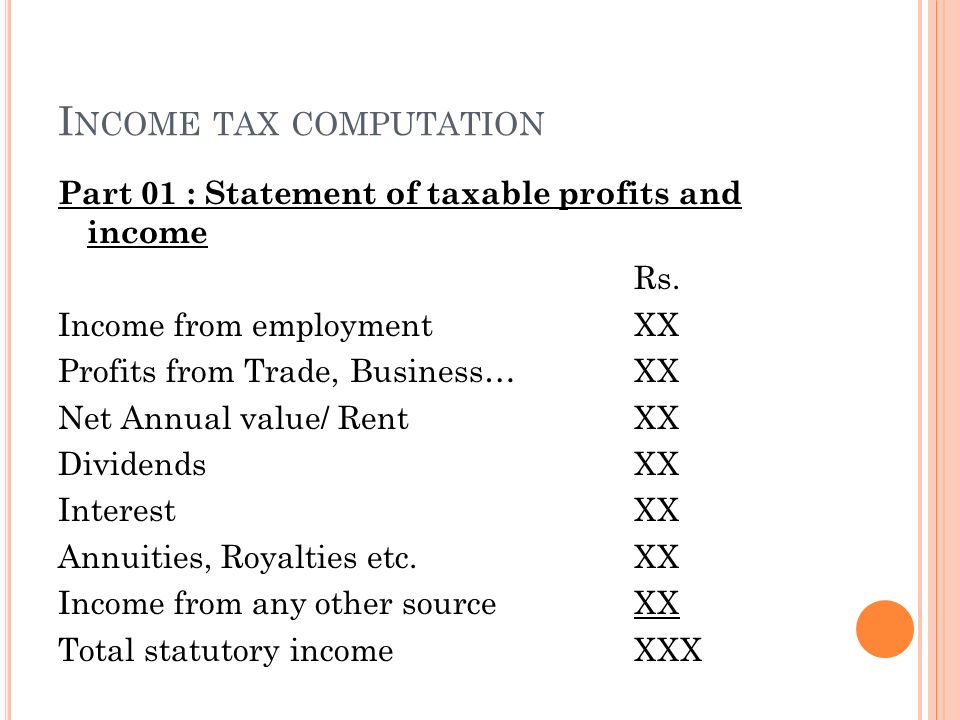

statutory income from employment

Use this form if you are a household member and want to promise to make your income andor assets available to help support sponsored. 1 1954 201b increased the limitation on self-employment income subject to tax for taxable years ending after 1954 from 3600 to 4200 and included as wages for purposes of computing self-employment income remuneration of United States citizens employed by a foreign subsidiary of a domestic corporation which.

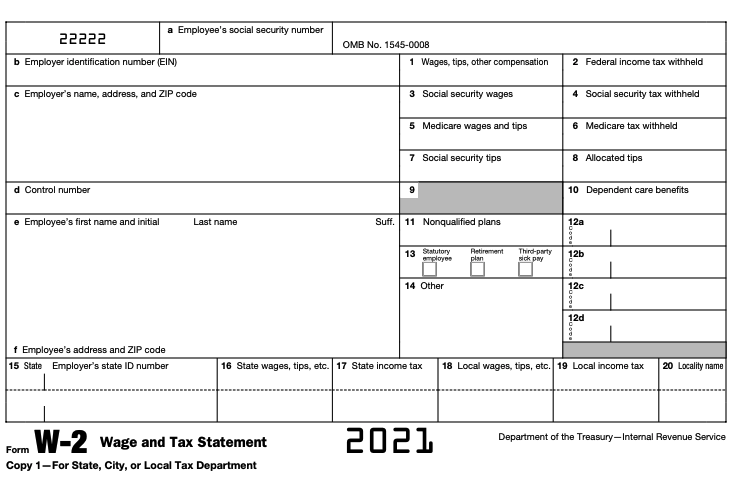

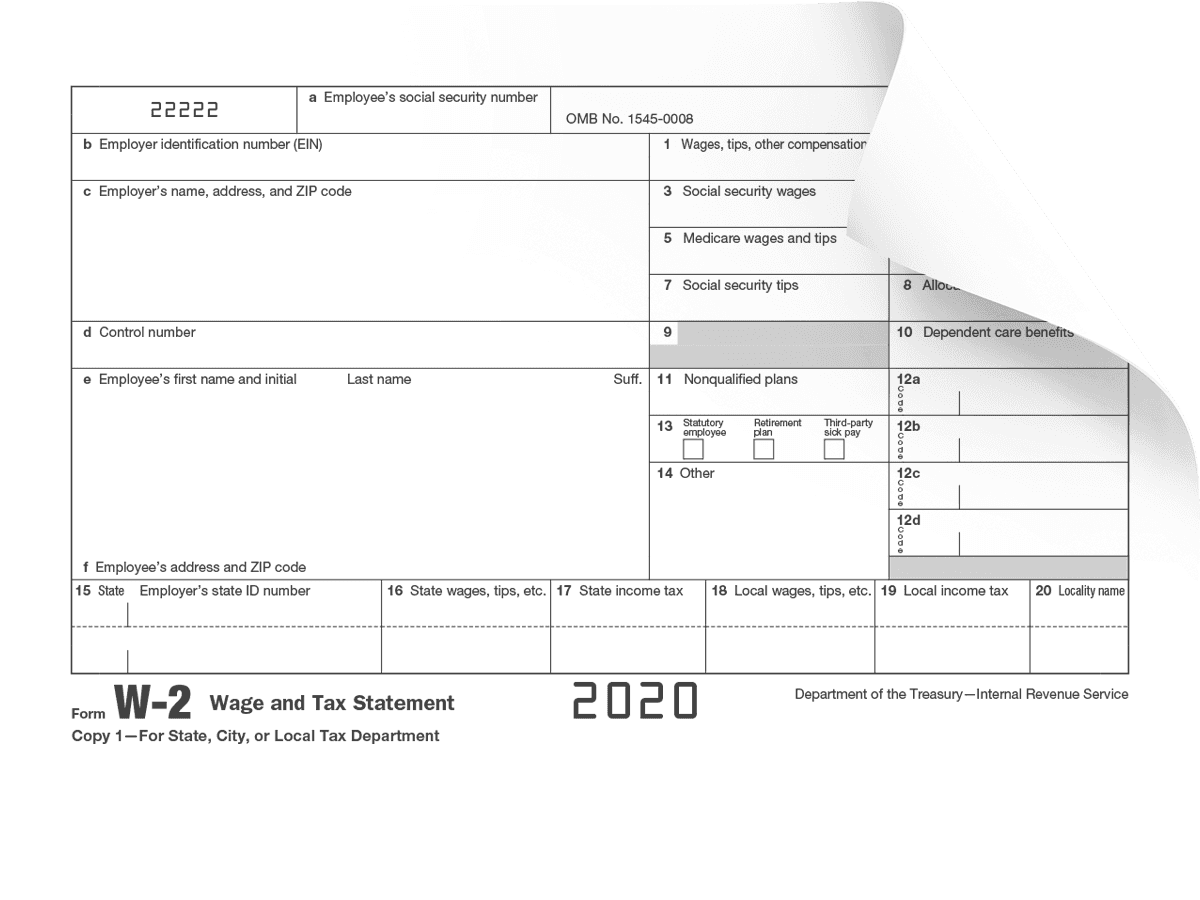

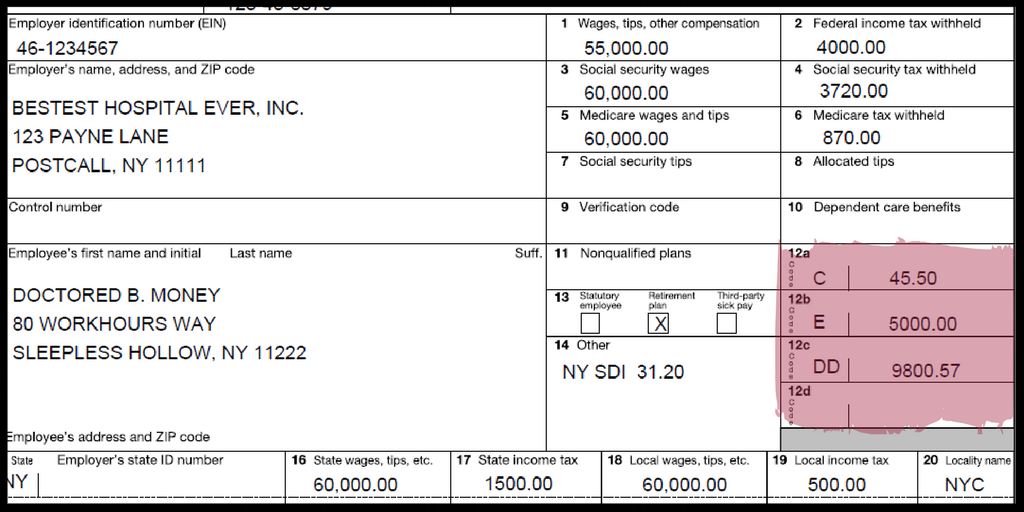

Understanding Your Tax Forms The W 2

Hawaii Kansas and Michigan exclude from coverage any employment that is subject to the Federal Fair Labor Standards Act if the State wage is higher than the Federal wage.

. Usually based on a contract one party the employer which might be a corporation a not-for-profit organization a co-operative or any other entity pays the other the employee in return for carrying out assigned work. When an employee is acknowledged as being hired at will courts deny the. A statutory tax rate is the legally imposed rate.

A statutory nonemployee. If your Statutory Sick Pay SSP is due to end. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate.

Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. Revenu brut hebdomadaire demploi. Earn an average of at least 123 per week.

A New Zealand Income Insurance scheme. Employees covered under the federal Fair Labor Standards Act are subject to the federal minimum wage of 725 but those not covered. The Government Business New Zealand and the New Zealand Council of Trade Unions are proposing a new way of better protecting workers and the economy.

Scottish starter tax rate. Have been ill for at least 4 days. B travel by the employee that is incidental to travel in the course of performing the duties of his or her employment.

Year of income means an income year within the meaning of the Income Tax Assessment Act 1997. In United States labor law at-will employment is an employers ability to dismiss an employee for any reason that is without having to establish just cause for termination and without warning as long as the reason is not illegal eg. The Georgia state minimum wage is 515.

If youre an employer who pays more than the weekly rate of Statutory Sick Pay you can only claim up to. Every year more than 100000 New Zealanders are made redundant laid off or have to stop working because of a health condition or disability. This Regulation may be cited as the Statutory Accident Benefits Schedule Effective September 1 2010.

PAYE tax rates and thresholds 2022 to 2023. Gross weekly employment income means in respect of an insured person the amount of the persons gross annual employment income as determined under subsection 2 divided by 52. Together with the Department of the Treasurys Internal Revenue Service IRS has the statutory and regulatory authority to ensure that workers receive the promised benefits.

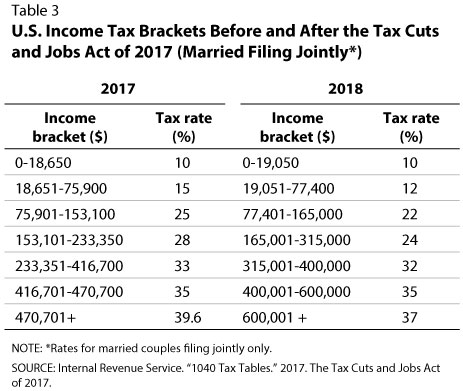

Employees work in return for wages which can be paid on the basis of an. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. An income tax could have multiple statutory rates for different income levels where a sales tax may have a flat statutory rate.

Employment is a relationship between two parties regulating the provision of paid labour services. Statutory Sick Pay SSP Calculate your employees Statutory Sick Pay. Firing because of the employees race religion or sexuality.

Tax credits Some tax credits reduce the amount of BIRT owed to the City. A qualifying day is a day an employee usually works on. A class of employee that is permitted to deduct work-related expenses on Schedule C instead of Schedule A.

Statutory maternity pay and leave. Maternity adoption and paternity calculator for employers. Workers compensation or workers comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employees right to sue his or her employer for the tort of negligenceThe trade-off between assured limited coverage and lack of recourse outside the worker.

242 per week 1048 per month 12570 per year. Beginning in tax year 2016 there is an exemption of the first 100000 in gross receipts and a proportionate share of net income from the Business Income and Receipts Tax. PAYE tax rates and thresholds 2021 to 2022.

Statutory employees are usually salespeople or other employees who. EBSA has principal jurisdiction over Title I of ERISA which requires persons and entities. If emailing us please include your full name address including postcode and telephone number.

The exemption provided by section 250 ITEPA 2003 is much wider than that provided by Extra- Statutory Concession A63. Scottish starter tax rate. Our current opening hours are 0800 to 1800 Monday to Friday and 1000 to 1700 Saturday.

Certain aliens noncitizens who are in the United States may file Form I-765 Application for Employment Authorization to request employment authorization and an Employment Authorization Document EAD. 242 per week 1048 per month 12570 per year. You can apply for new style Employment and Support Allowance.

The weekly rate is 9635. The Self-Employment Income Support Scheme claim service is now open. You can get more if your company has a sick pay scheme or.

HM Revenue Customs Published 22 May 2014. Statutory paternity pay and. Its paid by your employer for up to 28 weeks.

You can apply for new style ESA up to 3 months before your SSP ends. Updated to confirm that the online service for the first grant is closed. Employee Retirement Income Security Act ERISA 29 USC 1001 et seq.

You can get 9935 per week Statutory Sick Pay SSP if youre too ill to work. Year of tax means the year starting on 1 April 1987 and each later year starting on 1 April. In determining whether the person providing service is an employee or an independent contractor all information that provides evidence of the degree of control and independence must be considered.

To qualify for Statutory Sick Pay SSP you mustbe classed as an employee and have done some work for your employer.

100k W2 From Last Year Career Money Millionaire Job In 2022 Security Tips Federal Income Tax Software Sales

How To File Your Taxes If You Changed Or Lost Your Job Last Year

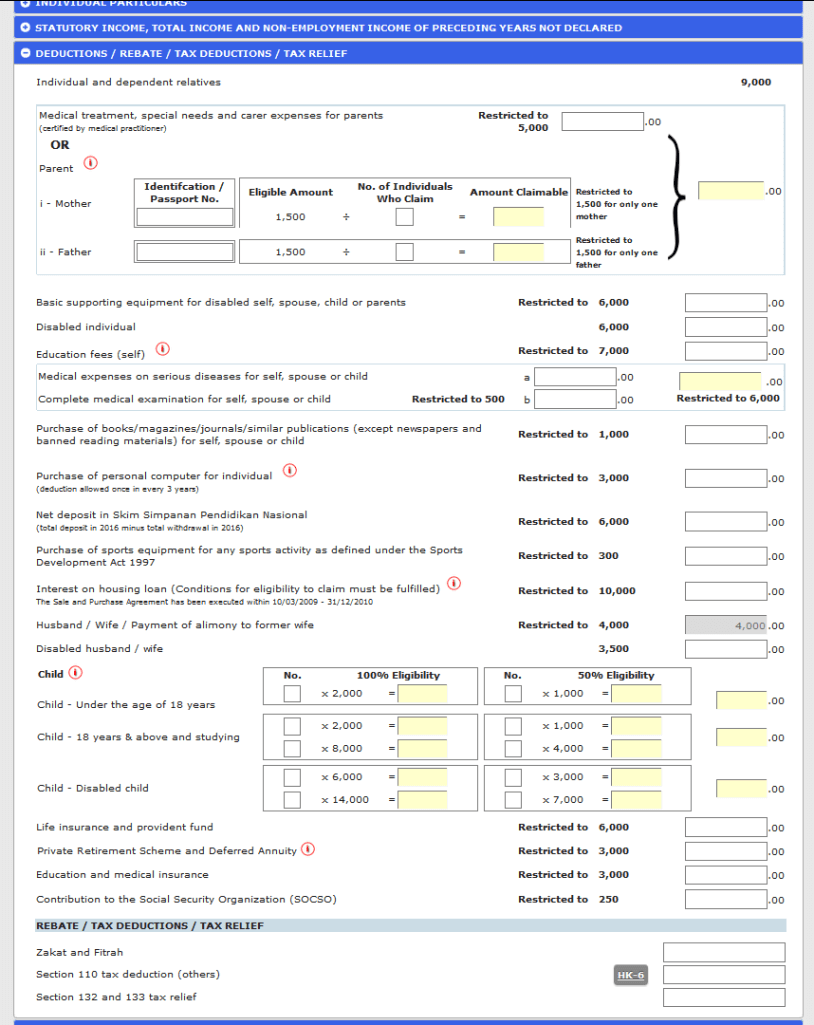

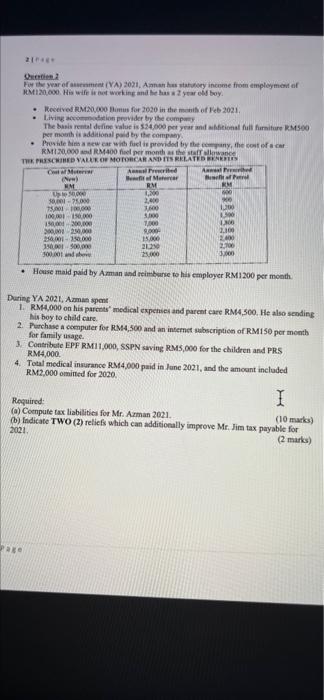

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Read Your W 2 Justworks Help Center

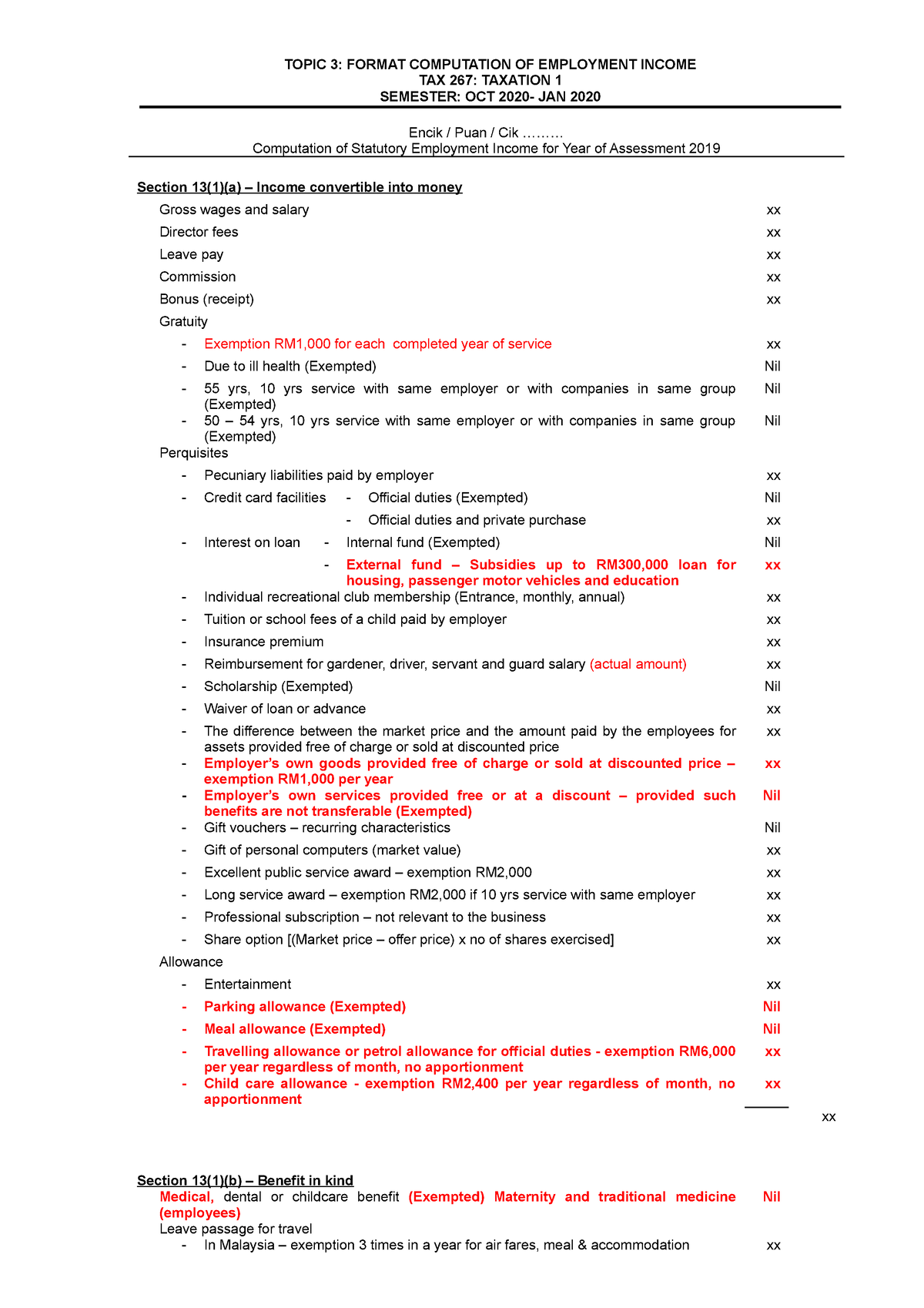

Topic 3 Format Employment Income Topic 3 Format Computation Of Employment Income Tax 267 Studocu

What You Need To Know About Proof Of Income Form Pros

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

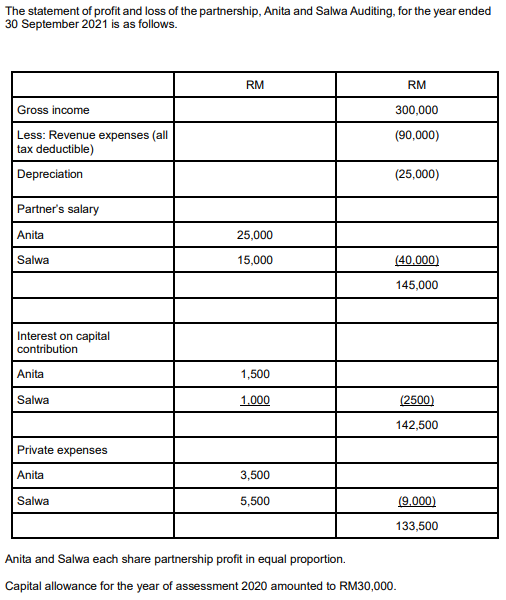

P Ost G Raduate D Iploma In Business Finance Taxation Ppt Download

Mtw Resident Meetings 06 29 2021 News Events Affordable Housing Workforce Housing Greenville Housing Authority Greenville Sc

![]()

2022 Irs Form W 2 Simple Instructions Pdf Download Onpay

Effects Of Income Tax Changes On Economic Growth

Ctos Lhdn E Filing Guide For Clueless Employees

Solved Required A Compute The Statutory Income In Respect Chegg Com

On Corporate Income Taxes Employment And Wages St Louis Fed

P Ost G Raduate D Iploma In Business Finance Taxation Ppt Download

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)

Comments

Post a Comment